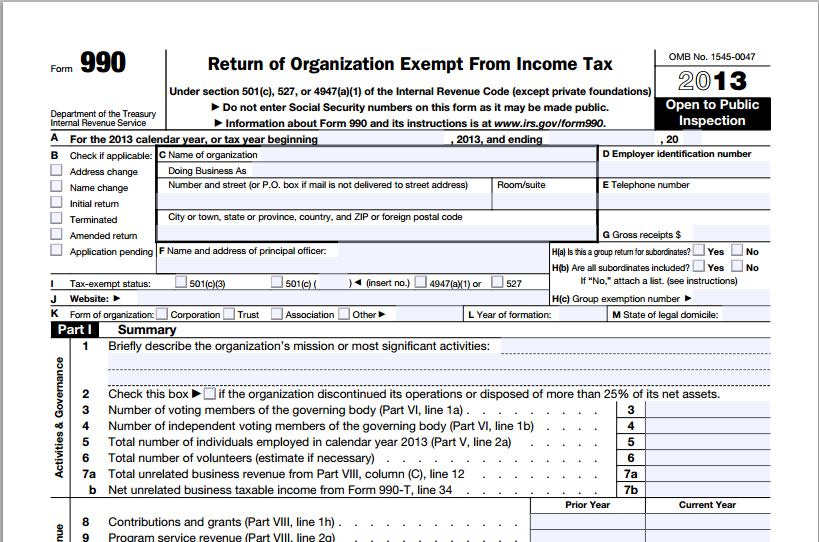

The type of tax year used by your organization is usually indicated in the organization's by-laws Īfter you file all the required information, you will have to specify if the gross receipts of your organization do not exceed $50,000 and if your organization is liquidated. The tax year consists of two consecutive months and can be either fiscal or calendar year. A tax-exempt organization, just like any other organization, must keep records and file returns based on the accounting period called a tax year. The annual tax year of the organization.It can be a president, vice president, treasurer, or secretary The principal officer is often specified by the organization's by-laws. Name and address of the principal officer in your organization.Your organization must obtain EIN, even if it does not have any employees The EIN is the unique nine-digit number that identifies your organization to the IRS. Employer Identification Number (EIN) of the organization.Your organization's website, if it has one.The current mailing address of your organization.If the organization uses or is known by other names, you must list them in the form If you have changed the legal name of your organization, inform the IRS about it before filing the e-Postcard To fill out the form, you will need the following information: To avoid technical issues, do not register or file this form using your smartphone and close multiple browsers before registration. Next year you will be able to file your e-Postcard without registration.

990 postcard registration#

Form 990-N filing requirements include a one-time registration on the IRS website.

0 kommentar(er)

0 kommentar(er)